Your Guide to Buying, Selling, and Investing in 2026

As we step into 2026, the Waterloo Region real estate market is presenting unique opportunities for buyers, sellers, and investors alike. While 2025 presented challenges related to affordability and economic uncertainty, those who approach this market with a solid strategy and accurate information are finding success. Let’s dive into what the numbers tell us and what it means for your real estate goals this year.

2025 Year in Review: What the Numbers Tell Us

The Waterloo Region saw 6,177 homes sold through the MLS® System in 2025, representing a decrease of 8.8% compared to 2024 and a notable 25.3% decrease compared to the previous ten-year average for annual sales. December alone saw 306 homes sold, down 9.5% year-over-year.

But here’s the important context: well-priced, well-prepared homes are still selling. This market rewards those who approach their sale or purchase strategically, not those who sit on the sidelines waiting for the “perfect” moment.

The Full Year Picture: 2025 vs 2024

When we look at the entire year of 2025 compared to 2024, we see a relatively consistent softening across all property types. These year-over-year numbers give us the most reliable picture of the market’s overall direction:

- Detached homes: 3,779 sales (down 7.7%) with an average price of $876,896 (down 3.7%)

- Townhouses: 1,174 sales (down 14.4%) with an average price of $611,256 (down 4.3%)

- Semi-detached: 484 sales (up 1.5%) with an average price of $635,412 (down 4.1%)

- Condominium apartments: 727 sales (down 11.6%) with an average price of $437,084 (down 7.4%)

Notice something? When we look at the full year, price decreases are fairly moderate across the board, ranging from 3.7% to 7.4%. This is a far cry from the dramatic headlines you might see about monthly fluctuations.

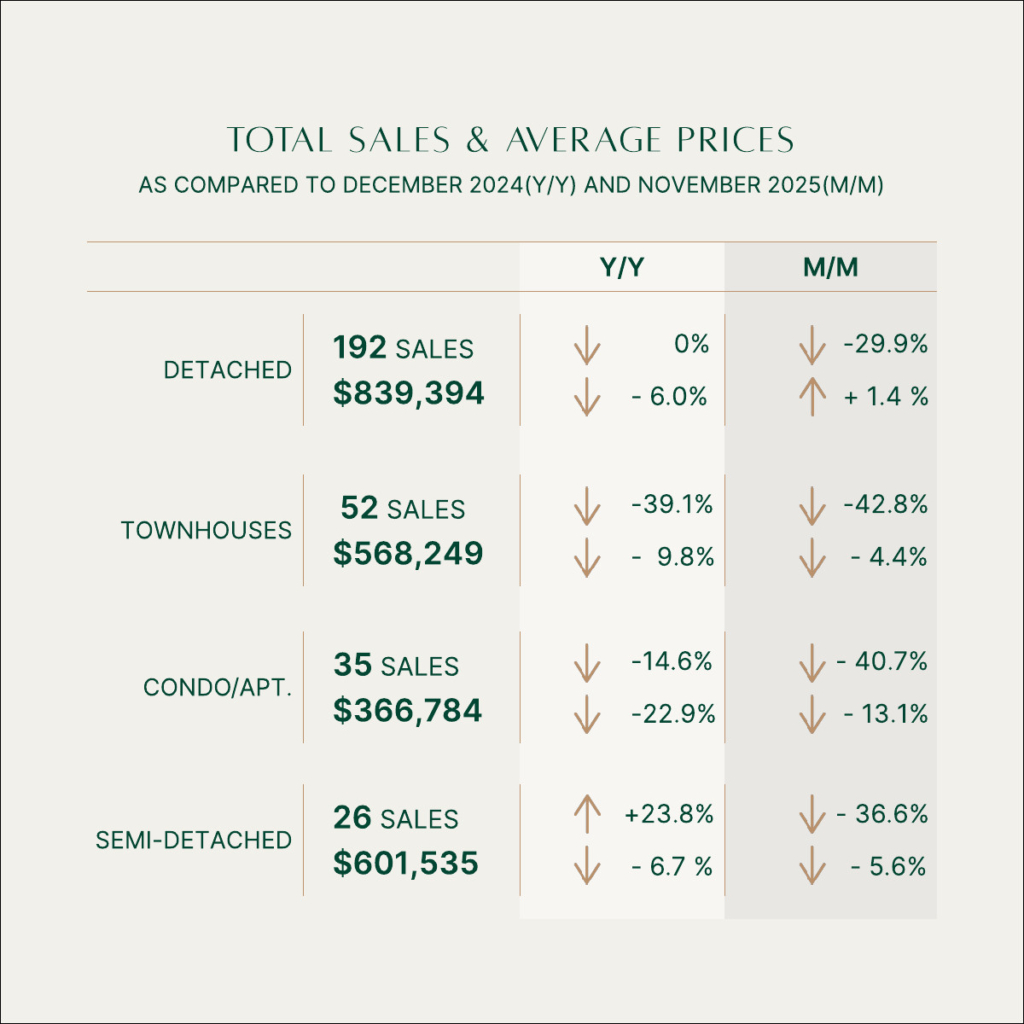

December’s Snapshot: Why Monthly Numbers Can Be Misleading

Now let’s look at December 2025 compared to December 2024. This is where you’ll see some more dramatic swings:

- Overall average: $716,911 (down 5.9% from Dec 2024, up 0.5% from Nov 2025)

- Detached: $839,394 (down 6.0% from Dec 2024, up 1.4% from Nov 2025)

- Townhouses: $568,249 (down 9.8% from Dec 2024, down 4.4% from Nov 2025)

- Condos: $366,784 (down 22.9% from Dec 2024, down 13.1% from Nov 2025)

- Semi-detached: $601,535 (down 6.7% from Dec 2024, down 5.6% from Nov 2025)

See the difference? The condo market shows a 22.9% decrease in December month-over-month, but only a 7.4% decrease for the full year. This is exactly why monthly comparisons can be misleading.

Understanding the Condo Market: What’s Really Happening

That 22.9% December decline grabbed headlines, but here’s the context: it compares one month (December 2025) to the same month the previous year (December 2024). Monthly numbers are heavily influenced by what actually sold that month, not necessarily the value of all condos in the market.

Here’s why monthly averages fluctuate so dramatically:

- If December 2024 had several high-end penthouse or large two-bedroom sales, that inflates the average for that month

- If December 2025 had more sales of smaller one-bedroom units or condos with higher fees, that pulls the average down

- The “average” is simply the total sale prices divided by the number of sales — it’s extremely sensitive to what’s in the mix

This is why the full-year number of 7.4% is much more meaningful than the December snapshot. Over 12 months, these fluctuations balance out, giving us a clearer picture of actual market conditions.

The real story: The condo market has softened more than other property types (7.4% vs 3.7-4.3% for other types), but it’s not the 22.9% freefall that a single month’s comparison might suggest. And even within that 7.4% average, there’s huge variation.

A well-located two-bedroom condo with parking in an established building with reasonable fees? Likely performing much better than a small one-bedroom in a building with high fees and limited amenities. Your specific property’s value depends on its unique characteristics, not the monthly average.

Where the Opportunities Are in 2026

First-Time Buyers: Your Window Is Open

After years of being priced out, first-time buyers are finding more breathing room in 2026. With increased inventory, softened prices, and more negotiating power, the market is shifting in your favour. Add to this the new federal and provincial HST exemption on new homes up to $1 million, and getting into the market is more achievable than it has been in recent years.

Important note: The HST exemption applies only to new construction, not resale homes. If you’re considering new builds, this incentive can represent substantial savings.

Upsizers: The Math Might Work Better Than You Think

If you’ve been hesitating to upsize because you’re worried about selling your current home for less than you’d hoped, consider this: yes, you’ll sell for less, but you’ll also buy for less.

With softened prices across all property types and increased negotiating power in a market with higher inventory, the gap between what you’ll sell your current home for and what you’ll pay for your dream home may actually be more favourable than in a heated market. Plus, sellers are more motivated, which means there’s room to negotiate on price, closing dates, and conditions.

Sellers: Strategy Is Everything

Make no mistake: this is not the seller’s market of 2021. Homes are taking longer to sell, and buyers have more options. That said, properties that are priced accurately from day one, staged well, and marketed strategically are still moving.

The key is to avoid overpricing based on what your neighbour sold for two years ago. Work with someone who understands current market conditions and can position your home competitively. In this market, the first two weeks on the market are critical — don’t waste them with an inflated price that turns buyers away.

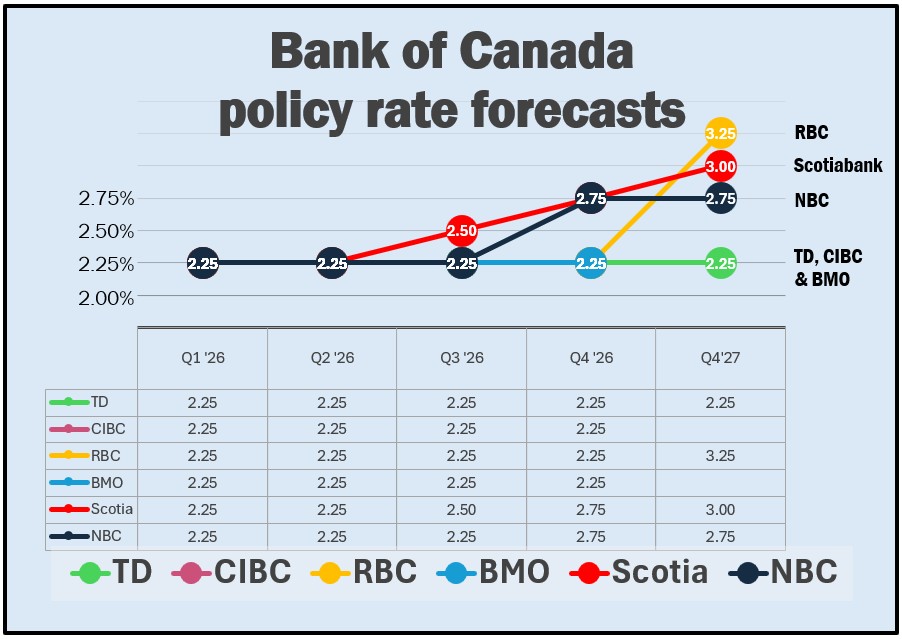

Interest Rate Outlook: What to Expect in 2026

After a sharp easing cycle in 2024 and early 2025, the conversation around interest rates has shifted. It’s no longer about how quickly the Bank of Canada will cut rates, but rather how long rates will remain on hold — and when the next move might eventually be higher.

The Consensus: Stability Through 2026

Most major banks expect the overnight rate to sit at 2.25% through much of 2026. This reflects a central bank that is broadly comfortable with inflation progress but cautious about declaring victory. Policymakers are widely expected to adopt a wait-and-see approach, guided by incoming inflation and labour-market data.

Here’s what the major banks are forecasting:

- TD Bank: Expects the policy rate to remain unchanged at 2.25% through the end of 2027.

- CIBC and BMO: Forecasts point to rates holding steady through 2026, though neither has released formal projections beyond that point.

- Scotiabank and National Bank: Anticipate the policy rate could edge higher by the fourth quarter of 2026.

- RBC: Projects rate hikes extending into 2027, with the overnight rate rising back toward 3.25%.

What This Means for Borrowers

The implication for borrowers is a more stable, but not permanently lower, rate environment. Variable-rate relief appears largely behind us, with the next phase likely defined by an extended hold rather than further cuts.

Fixed mortgage rates may also face upward pressure over time as markets begin to price in the possibility of future tightening. If you’re coming up for renewal or considering a purchase, this is a good time to evaluate whether locking in a fixed rate makes sense for your situation.

In short, 2026 is shaping up as a year of rate stability, but with growing discussion around what comes next as the economic cycle matures.

Inventory Levels: Understanding the Supply Side

At the end of December, there were 1,188 homes available for sale in active status, representing a 15.9% increase from the same month last year and surpassing the previous ten-year average of 595 homes in December. Total inventory across the market increased by 27.8%, resulting in a 2.3-month supply of all property types.

Breaking it down by property type:

- Condominium apartments: 4.9 months’ supply (highest inventory)

- Townhouses: 3.0 months’ supply

- Detached homes: 1.7 months’ supply (lowest inventory)

The number of months of inventory represents the time it would take to sell all current inventory at the current sales rate.

Seasonal Fluctuations and What’s Coming

It’s important to note that December inventory levels tend to be more impacted by seasonal fluctuations. As we’ve returned to a more normal market cycle, many properties were removed from the market during the holidays to be relisted in the coming months. Similarly, many listings that were held off for the traditional spring market will be coming up soon.

What does this mean? We should be prepared for inventory to increase further as these listings hit the market in the weeks ahead. For buyers, this means even more options. For sellers, it reinforces the importance of strategic pricing and presentation — you’ll be competing for attention in a busier marketplace.

In 2025, 13,872 new listings were added to the MLS® System in Waterloo Region, an increase of 5.2% compared to 2024 and a 15.7% increase compared to the previous ten-year annual average. This trend is likely to continue into early 2026.

The Bottom Line: Planning Beats Timing

The Waterloo Region real estate market in 2026 is not about finding the “perfect” moment — it’s about having the right plan for your situation.

Whether you’re a first-time buyer taking advantage of more options and better negotiating power, an upsizer recognizing that lower selling prices also mean lower purchase prices, or a seller understanding the importance of strategic pricing, success comes down to preparation and execution.

The data is clear: well-priced homes are selling, opportunities exist across all segments, and interest rates are expected to remain stable through most of the year. The question isn’t whether to make a move — it’s whether you have the right strategy to make it successful.

Ready to create your plan for 2026? Let’s talk about what these market conditions mean specifically for you.