The Waterloo Region real estate market continued its path toward stabilization in August 2025, with new data from the Cornerstone Association of REALTORS® revealing important trends that both buyers and sellers should understand. Here’s what the latest market statistics mean for your real estate decisions.

Market Overview: Signs of Stabilization

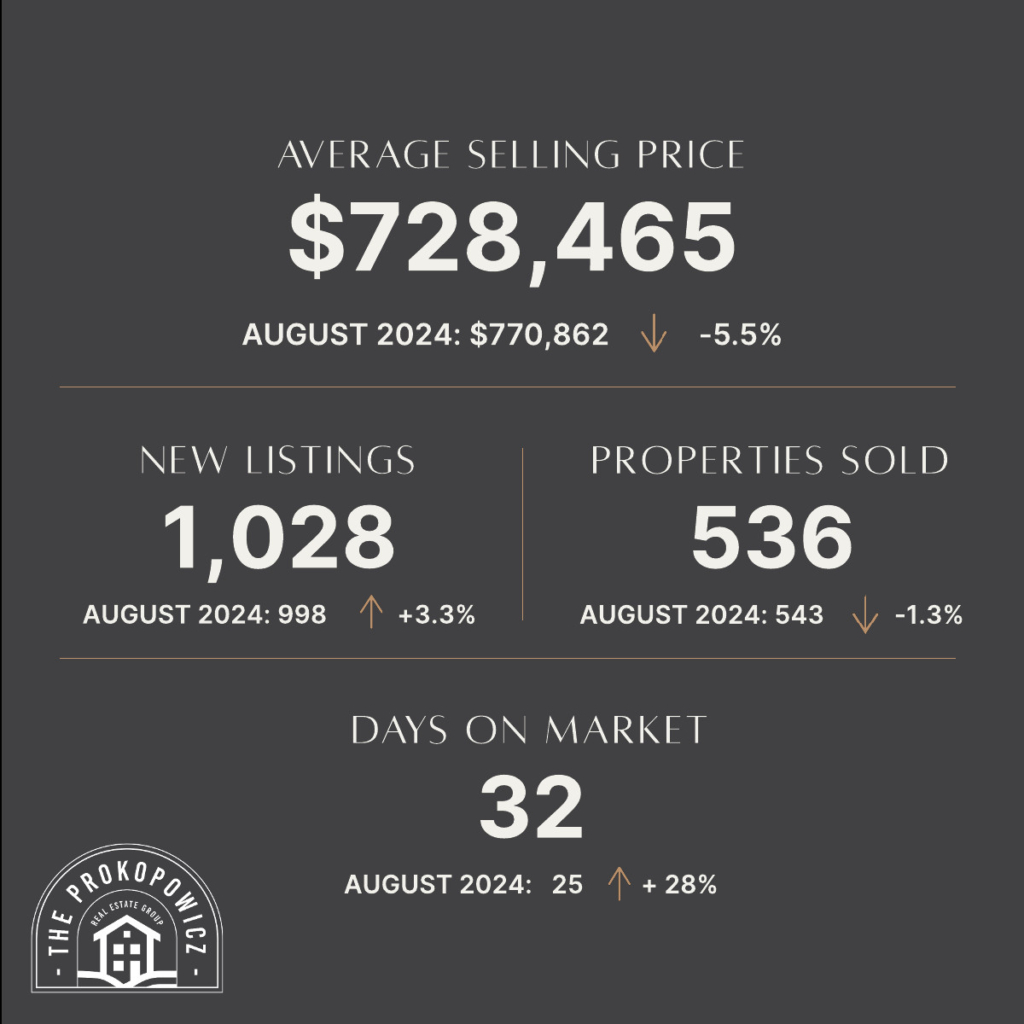

August saw 536 home sales across the Waterloo Region’s MLS® System, representing a modest 1.3% decrease from the same period last year. While this might seem concerning at first glance, market spokesperson Christal Moura notes that “the market is showing signs of stabilization, though we’re seeing a continued cooling trend compared to last year.”

The more significant story lies in the comparison to historical averages. Sales were down 23.1% compared to the ten-year average for August, indicating the market has moved away from the heated conditions of recent years toward more balanced territory.

Property Type Performance: A Mixed Picture

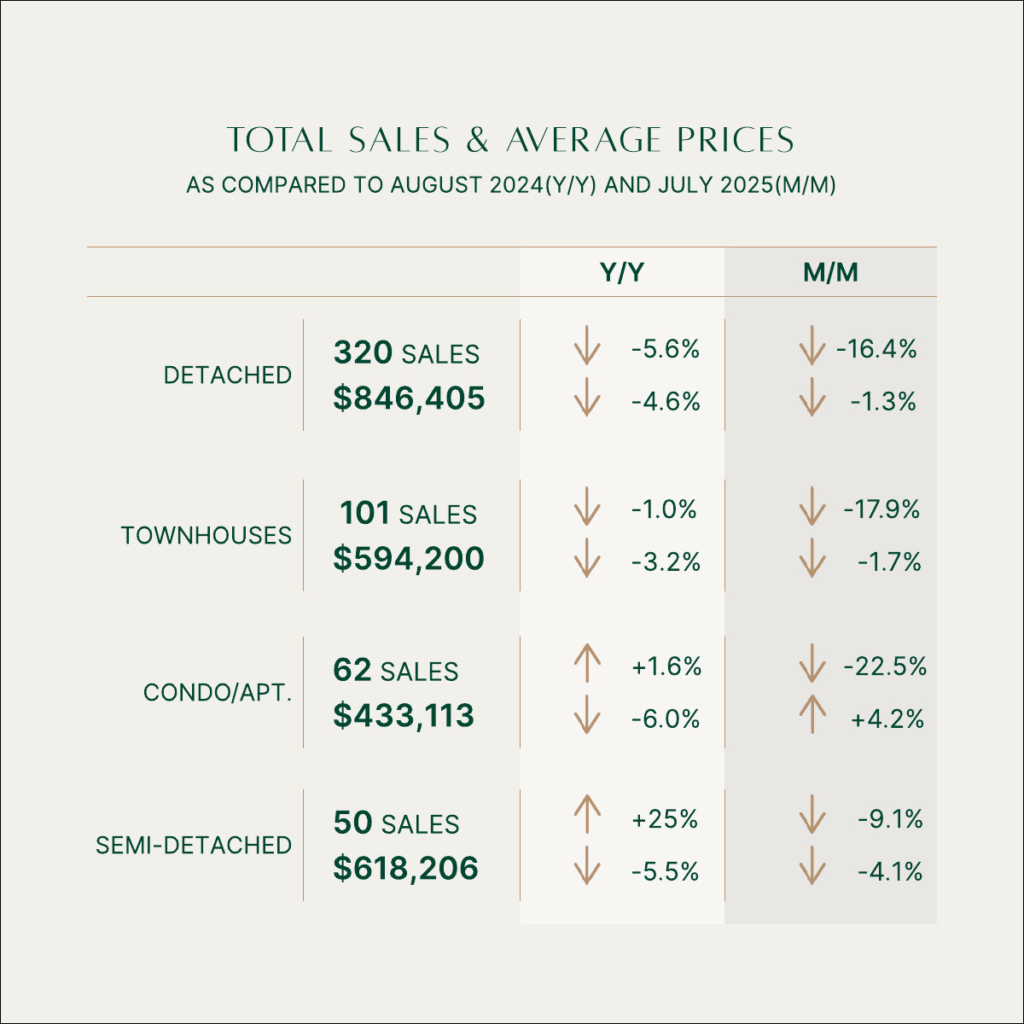

Different property types are experiencing varying market conditions:

Detached Homes led the market with 320 sales, though this represents a 5.6% decline from August 2024. The average sale price of $846,405 reflects a 4.6% decrease year-over-year.

Semi-Detached Homes were the standout performers, with sales jumping 25% to 50 units sold. However, average prices dropped 5.5% to $618,206.

Condominiums showed resilience with 62 units sold (up 1.6% from last year), averaging $433,113. Interestingly, condo prices actually increased 4.2% from July to August.

Townhouses remained relatively stable with 101 sales (down just 1.0%), averaging $594,200.

Understanding Price Trends: Beyond the Averages

The overall average sale price across all property types was $728,465 in August, down 5.5% from the previous year. However, it’s crucial to understand that average prices can be misleading due to changes in the mix of properties sold.

For more accurate price trend analysis, the MLS® Home Price Index (HPI) provides better insight:

- Kitchener-Waterloo Composite HPI: $675,400 (down 7.1% year-over-year)

- Cambridge Composite HPI: $701,100 (down 5.6% year-over-year)

These HPI figures show consistent downward pressure across both major market areas, with Kitchener-Waterloo experiencing slightly more significant declines.

Market Dynamics: Supply and Timing

The market is showing encouraging signs for buyers in terms of selection and negotiating power:

Increased Inventory: August brought 1,028 new listings, up 3.3% from last year and 11% above the ten-year average. This growing inventory gives buyers more options and potentially more negotiating power.

Extended Market Time: Homes took an average of 32 days to sell in August, compared to just 25 days in August 2024 and a five-year average of 19 days. This slower pace benefits buyers by reducing pressure and allowing more time for due diligence.

Economic Context: Interest Rates and Inflation

The broader economic environment continues to influence local market conditions. The Bank of Canada’s decision to hold interest rates at 2.75% for the third consecutive time provides some predictability, though economic uncertainty remains a factor.

As Moura explains, “We are operating in a complex economic environment… economic uncertainty and the Bank’s focus on inflation, especially regarding shelter costs, remind us that we are in a period where both buyers and sellers need to stay informed.”

What This Means for Buyers

Current market conditions present several advantages for buyers:

- More Choice: Increased listings provide better selection across all property types

- Less Competition: Longer market times mean less pressure from competing offers

- Price Moderation: Downward price pressure creates opportunities for negotiation

- Rate Stability: Consistent interest rates allow for better financial planning

What This Means for Sellers

Sellers face a more challenging but still manageable market:

- Realistic Pricing: Properties need competitive pricing to sell within reasonable timeframes

- Enhanced Presentation: With more inventory available, making your property stand out is crucial

- Professional Guidance: Working closely with a REALTOR® becomes even more valuable in navigating current conditions

- Patience: Accept that sales may take longer than in previous years

Looking Ahead

The Waterloo Region market appears to be transitioning from the rapid price appreciation of recent years to a more balanced state. While this adjustment period brings challenges for sellers and opportunities for buyers, it ultimately points toward a healthier, more sustainable market.

Both buyers and sellers should focus on their long-term housing needs rather than trying to time the market perfectly. Current conditions favour informed decision-making over quick reactions, making professional real estate guidance more valuable than ever.

Key Takeaways

- The market is stabilizing with modest year-over-year sales declines

- Price pressure is evident across most property types and regions

- Increased inventory and longer sale times favor buyers

- Interest rate stability provides some economic predictability

- Professional guidance is essential for navigating current conditions

Whether you’re looking to buy or sell in the Waterloo Region, understanding these market dynamics will help you make informed decisions aligned with your housing goals and financial situation.