The Waterloo Region real estate market is telling a story of transition and adaptation. After years of rapid price growth and lightning-fast sales, June 2025 data reveals a market that’s settling into a more sustainable rhythm—one that offers both challenges and opportunities for buyers and sellers alike.

The Numbers Tell the Story

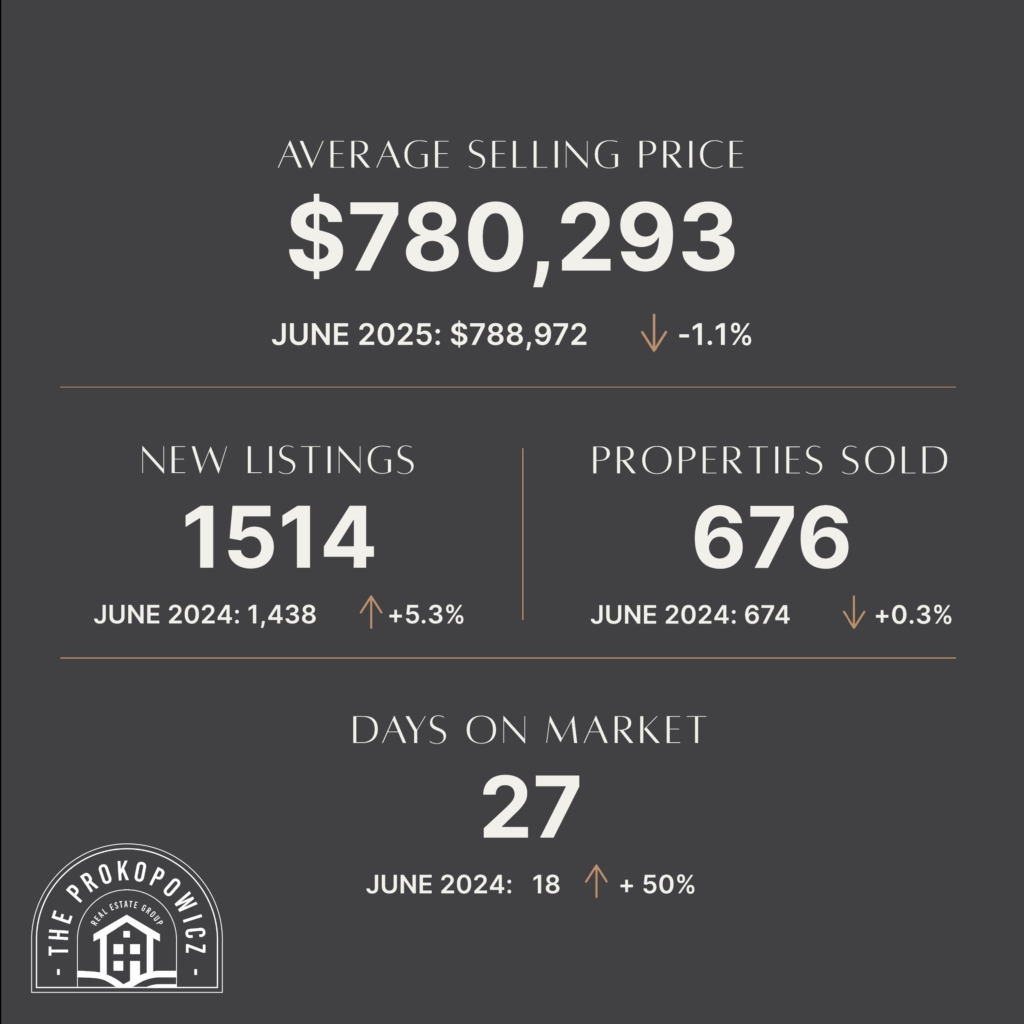

With 676 homes sold through the MLS® system in June, the Waterloo Region market showed remarkable stability compared to the same period last year, posting a modest 0.3% increase. However, this figure sits 21.7% below the ten-year average, signaling that while the market has found its footing, it’s operating at a more measured pace than the frenzied activity of recent years.

“While home sales in June were relatively stable year-over-year, we’re seeing a more balanced market emerge in Waterloo Region,” explains Christal Moura, spokesperson for the Waterloo Region market. This balance is perhaps the most significant development for both buyers and sellers navigating today’s market conditions.

A Tale of Different Property Types

The June data reveals distinct patterns across property categories that reflect evolving buyer preferences and affordability pressures:

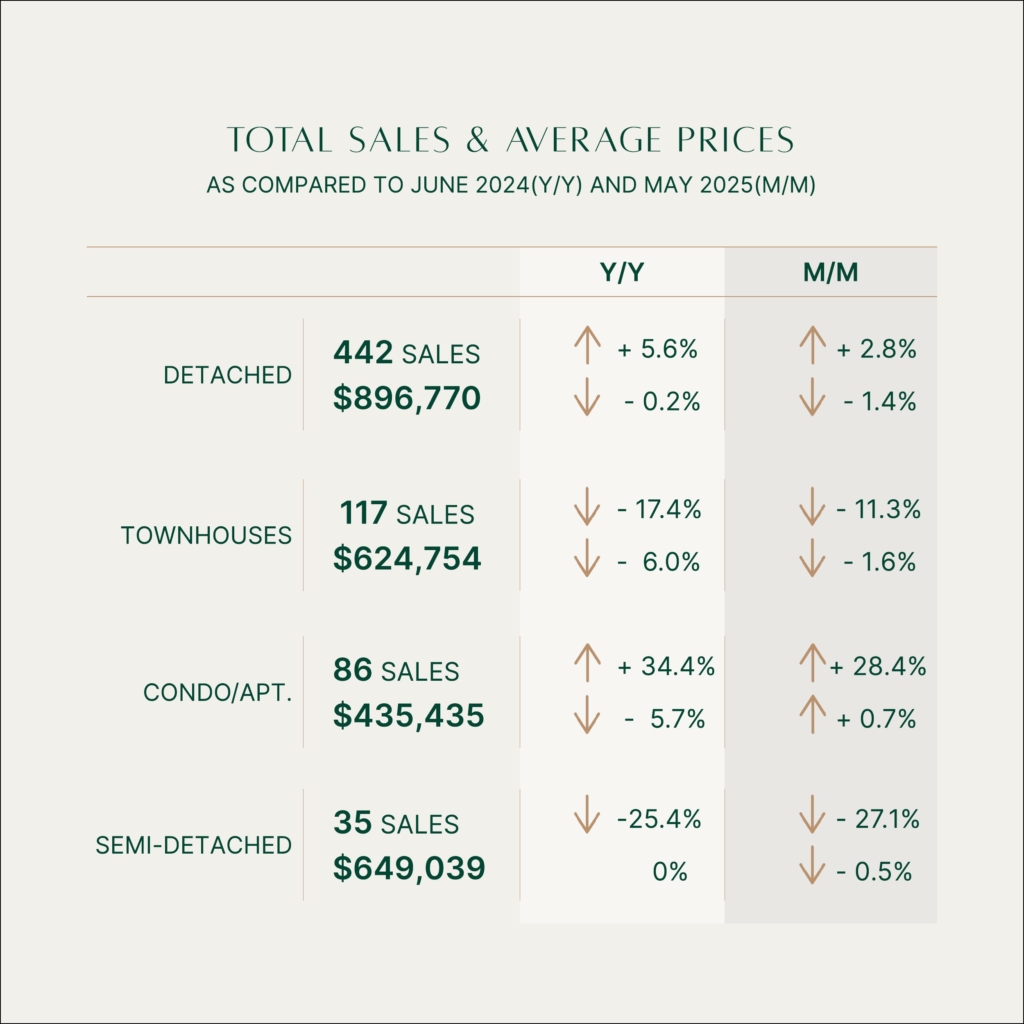

Detached homes continued to show strength with 442 sales, marking a 5.6% increase from June 2024. Despite this positive momentum, the average sale price of $896,770 represents a slight 0.2% decrease year-over-year, suggesting buyers are finding value in this traditionally premium segment.

Condominiums emerged as the clear winner, with 86 units sold—a remarkable 34.4% increase from the previous year. At an average price of $435,435, these properties are attracting buyers seeking more affordable entry points into homeownership. This surge suggests a cohort of buyers looking for housing options that align with current economic realities.

Townhouses faced headwinds with 113 sales, down 17.4% from June 2024, while the average price of $624,754 declined 6.0% year-over-year. This segment appears to be caught between the affordability of condos and the space appeal of detached homes.

Semi-detached homes saw 35 sales, down 25.4% from last year, though prices remained stable at $649,039, essentially matching June 2024 levels.

The HPI Tells a Deeper Story

While average sale prices provide a snapshot, the MLS® Home Price Index (HPI) offers more nuanced insights into market trends. The benchmark prices show year-over-year decreases across most categories, with Kitchener-Waterloo’s composite HPI at $686,100 (-7.5% YoY) and Cambridge at $723,400 (-4.2% YoY).

These adjustments reflect a market recalibrating after years of rapid appreciation. Rather than signaling distress, these price movements suggest a healthier, more sustainable trajectory that aligns with economic fundamentals.

Market Dynamics: Time and Choice Return

Perhaps the most telling indicator of market evolution is the return of time and choice to the buying process. Homes took an average of 27 days to sell in June, compared to just 18 days in the same month last year. While this represents a significant shift from the five-year average of 15 days, it signals a welcome return to more normal market conditions.

The increase in new listings to 1,514 (up 5.3% year-over-year and 15.1% above the ten-year average) means buyers have more options and less pressure to make hasty decisions. This inventory growth is creating space for more thoughtful decision-making and proper due diligence.

Regional Strengths Remain Intact

Despite the market adjustments, Waterloo Region’s fundamental appeal remains strong. The area’s diversified economy, anchored by technology companies, manufacturing, and educational institutions, continues to attract both families and businesses. This economic foundation provides stability even as market conditions evolve.

“These market shifts underscore the importance of working with a professional REALTOR® who can provide crucial guidance on pricing strategies, market timing, and negotiation,” Moura emphasizes. “Their expertise helps both buyers and sellers adjust their expectations and make informed decisions in this evolving market environment.”

What This Means for Market Participants

For Buyers: The current market offers advantages not seen in years. With more inventory, longer selling times, and modest price adjustments, buyers have returned leverage in negotiations. The key is patience and working with professionals who understand local market nuances.

For Sellers: Success requires realistic pricing and strategic positioning. While the days of multiple offers above asking price have diminished for many properties, well-priced homes in desirable locations are still attracting serious buyers.

For Investors: The market presents opportunities for those with patience and capital. Price adjustments may create entry points, while the region’s long-term growth prospects remain positive.

Looking Forward: A Market in Transition

The June 2025 data suggests Waterloo Region is experiencing a healthy market correction rather than a collapse. The combination of increased inventory, longer selling times, and modest price adjustments points toward a more balanced market that serves both buyers and sellers more effectively than the extremes of recent years.

This transition period requires adaptability from all market participants. Properties in different areas and price ranges may experience varied trends—some still seeing rapid sales while others take months to find the right buyer. Understanding these micro-market dynamics becomes crucial for success.

The Waterloo Region market’s evolution reflects broader economic adjustments while maintaining the fundamental strengths that make it an attractive place to live and invest. As the market continues to find its new equilibrium, the emphasis shifts from speed to strategy, from bidding wars to informed decision-making.

For those considering a move in this market, partnering with knowledgeable local professionals who understand these nuanced, property-specific trends remains essential for achieving the best outcomes in this evolving landscape.